U.S. Black Rigid Plastic Packaging Market Companies Insights 2026

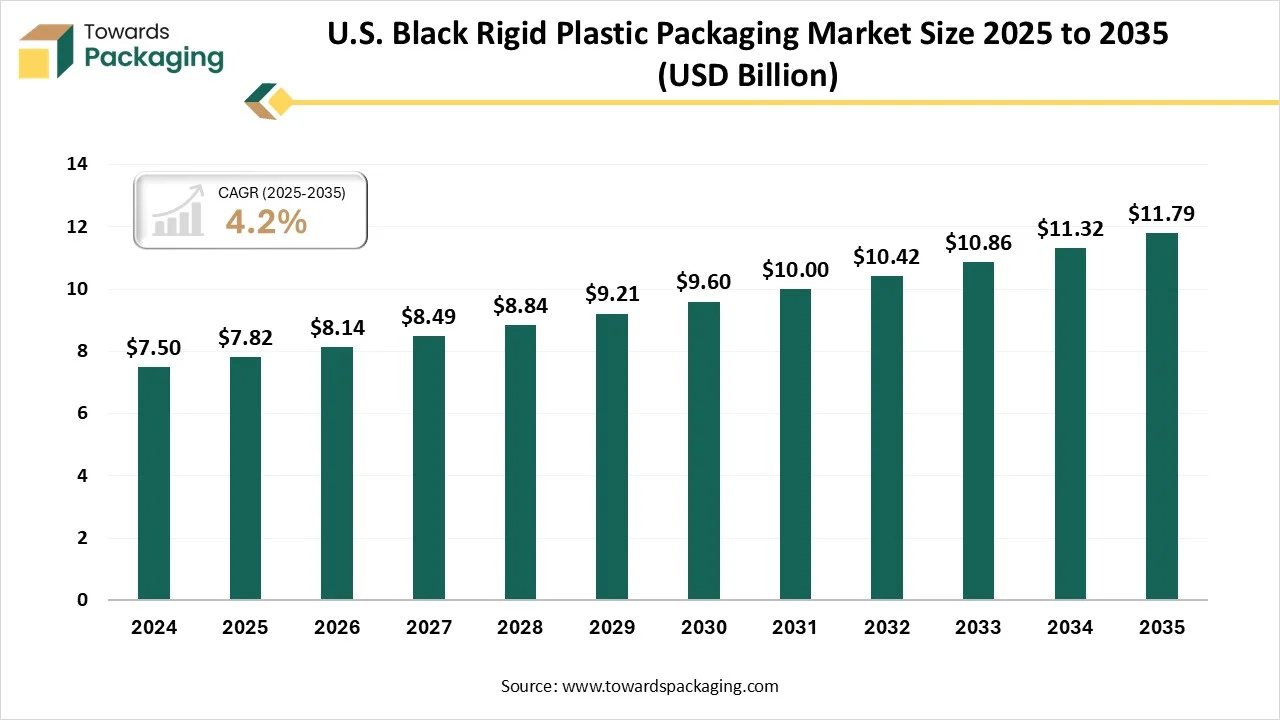

As highlighted by Towards Packaging research, the global U.S. black rigid plastic packaging market, valued at USD 7.82 billion in 2025, is expected to reach USD 11.79 billion by 2034, registering a CAGR of 4.2% throughout the forecast period.

Ottawa, Jan. 15, 2026 (GLOBE NEWSWIRE) -- The global U.S. black rigid plastic packaging market, which stood at USD 7.82 billion in 2025, is projected to grow further to USD 11.79 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising demand from food, personal care, and industrial sectors for durable, lightweight, and visually premium packaging solutions that support product protection and brand differentiation.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Takeaways

- By material type, the high-density polyethylene (HDPE) segment dominated the market share in 2024.

- By material type, the polypropylene (PP) segment is expected to grow at the fastest rate between 2026 and 2035.

- By product type, the bottles and jars segment led the market share in 2024.

- By product type, the trays & containers segment is projected to grow the fastest between 2026 and 2035.

- By end-use industry, the food & beverages segment dominated the market share in 2024.

- By end-use industry, the pharmaceutical and healthcare segment is projected to grow at the fastest rate between 2026 and 2035.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5934

Key Technological Shifts

- Improved molding technologies: Manufacturers are adopting advanced injection and blow molding techniques to produce stronger, more uniform black rigid containers with better surface finish and lower defect rates.

- Light-weight packaging designs: Companies are redesigning bottles, trays, and containers to use less plastic while maintaining durability, helping reduce material costs and carbon footprint.

- High-quality recycled plastic usage: There is a growing shift toward post-consumer recycled (PCR) resins that match the performance of virgin plastics, even for food-grade black rigid packaging

- Recyclability-focused pigment innovation: New carbon-free and degradable black pigments are being developed to improve sorting efficiency in recycling facilities, addressing long-standing recycling challenges.

- Mono material packaging development: Brands are moving away from multi-layer structures toward single-material rigid packaging, making recycling easier and more cost-effective.

- Automation and smart manufacturing: Use of robotics, AI-based inspection, and automated production lines is increasing to improve consistency, reduce waste, and speed up production cycles.

Market Overview

The U.S. black rigid plastic packaging market is witnessing a rapid growth, motivated by its extensive use in industrial applications, food and drink, cosmetics, and pharmaceuticals. High durability, superior barrier protection, and a premium appearance that improves shelf appeal are all provided by black rigid plastics. To achieve sustainability objectives, manufacturers are concentrating more on lightweight designs and enhanced recyclability. Additionally, the market is still expanding due to the growing demand for tamper-resistant and protective packaging.

Opportunities

- Recyclable Black Packaging Solutions: Developing detectable and carbon-free black pigments creates strong opportunities as brands and retailers seek packaging that aligns with recycling infrastructure.

- High PCR content rigid packaging: Increasing demand for packaging with higher post-consumer recycled content opens opportunities for suppliers offering food-grade and high-performance PCR black plastics.

- Premium & luxury product packaging: Black rigid packaging continues to be preferred in cosmetics, personal care, and premium food segments, creating growth opportunities for high finish and custom designs.

- E-commerce optimized rigid containers: Rising online sales are driving demand for impact-resistant, stackable, and lightweight black rigid packaging suitable for automated fulfillment and last-mile delivery.

-

Smart and connected packaging: Integrating QR codes and digital tracking features offers opportunities to support traceability, anti-counterfeiting, and consumer engagement.

Segmental Insights

By Material Type

The high-density polyethylene (HDPE) segment dominates the U.S. black rigid plastic packaging market because of its superior durability, cost-effectiveness, and chemical resistance. Manufacturers choose it because of its extensive use in food, beverage, and household product packaging, which enables a constant supply and dependable performance across a range of applications. HDPEs market position is further strengthened by its superior recyclability and compatibility with automated filling and labeling systems.

The polypropylene (PP) segment is growing rapidly because, in comparison to conventional HDPEE, it provides greater heat resistance and more design flexibility. Brands looking for cutting-edge packaging solutions are adopting it more quickly due to its lightweight characteristics, recyclability, and suitability for high-end packaging applications in food, personal care, and cosmetics. PPs growth is also being fueled by consumer demand for aesthetically pleasing, customizable packaging and the growing emphasis on sustainability.

By Product Type

The bottles and jars segment dominated the market because of their adaptability and popularity in food and drink, personal care, and household cleaning products. They are a mainstay in black rigid packaging because of their consistent production, ease of filling, and compatibility with different types of closures. Bottles and jars, strong consumer familiarity, and demonstrated supply chain effectiveness contribute to their continued dominance.

The trays & containers segment is growing rapidly as e-commerce and ready-to-eat meals require packaging that is sturdy, lightweight, and stackable. To increase convenience, preserve product integrity, and boost sustainability, brands are progressively implementing cutting-edge designs in this market. Additionally, new designs with improved tamper-proof and heat-resistant features are becoming more widely used in a variety of industries.

By End Use Industry

The food & beverages segment dominated the market due to the high consumption of packaged goods and the need for safe, durable, and attractive packaging solutions. Black rigid packaging provides effective protection, shelf appeal, and compatibility with various filling processes, making it the preferred choice for food and beverage manufacturers. Ongoing product innovation, such as resealable containers and portion-controlled packaging, further drives demand in this sector.

The pharmaceutical and healthcare segment is growing rapidly, fueled by the growing need for packaging that is secure, tamper-evident, and compliant with regulations. Because black rigid packaging can shield goods from light contamination and damage, it is becoming increasingly popular for medications, supplements, and medical devices. Strict regulations and growing consumer awareness of medication safety and hygiene contribute to the growth.

More Insights of Towards Packaging:

- Fiber-based Packaging Market Size, Trends, Segments, Regional Insights & Competitive Analysis to 2035

- Canada Household Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Corrugated Boxes Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Customized Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Beverage Carton Packaging Machinery Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Flexible Green Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Multiwall Bags Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Food and Beverage Metal Cans Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Biodegradable Plastics Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Folding Carton in Healthcare Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Multilayer PET Bottles Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Flexible Packaging Market Size, Trends, Segments, Share and Companies 2025-35

- U.S. Sustainable Packaging Market Size, Segments, Companies and Competitive Analysis 2025-2034

- Trifold Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Robotic Palletizers & De-Palletizers Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Eco-Friendly Barrier Coatings Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Petrochemical Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Plastic Liner Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Healthcare and Laboratory Label Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA)

- Fast-Food Containers Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

Country Level Analysis

The U.S. is growing due to high demand from the industrial personal care, food and beverage, and cosmetics sectors. Advanced manufacturing capabilities, high consumption of packaged goods, and the quick growth in e-commerce all contribute to growth. Innovation in recyclable black pigments and high PCR rigid packaging solutions is being accelerated by sustainability regulations such as recycled content requirements and extended producer responsibility laws. The U.S. also sets the standard for premium packaging design and the adoption of smart packaging.

Recent Developments

- In September 2025, Waste Management (WM) upgraded its Germantown facility with laser-based optical sorters that specifically detect and capture black rigid plastic packaging for commodity resale.

- In April 2024, Bpacks launched the world’s first bark-based rigid packaging technology, providing a low-carbon, biodegradable alternative that can be colored black for standard industrial equipment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Players

- Anchor Packaging LLC: Specializes in premium, high-heat containers and clear-lid packaging designed specifically for restaurant takeout and grocery deli displays.

- Constantia Flexibles (US): Focuses on high-performance rigid lids and specialty containers for the dairy and pharmaceutical sectors, emphasizing sustainable material transitions.

- Dart Container Corporation: A massive supplier of foodservice disposables that produces a wide range of rigid plastic bowls, cups, and trays used throughout the hospitality industry.

- D&W Fine Pack LLC: Manufacturers a diverse catalog of single-use rigid containers and cutlery, often utilizing recycled content for grocery and food service applications.

- EasyPak: Focuses on custom thermoformed packaging for the food industry, providing specialized rigid containers for produce, bakery items, and deli products.

- Genpak LLC: Produces high-quality rigid food containers and serving trays, known for their durable hinged-lid designs and microwave-safe material options.

Other Players

- Graham Packaging Company LP

- Greif Inc.

- Novolex Holdings, LLC

- Placon

- Printpack

- Sabert Corporation

- Sealed Air Corporation

- Sigma Plastics Group

- US Pack Group

Segments Covered in the Report

By Material Type

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Others (PVC, PS, Bioplastics)

By Product Type

- Bottles & Jars

- Trays & Containers

- Tubs, Cups & Pots

- Caps & Closures

- Others

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household & Industrial Products

- Others

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5934

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Fiberboard Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Cleanroom Contract Packaging Service Market Size, Trends, and Competitive Landscape, 2025-2035

- Feed Encapsulation Market Size, Share, Trends, Segments, Regional Outlook, and Competitive Landscape to 2035

- Thermoformed Food Packaging Trays Market Size, Share, Trends, and Forecast (2025-2035)

- Tire Packaging Film Market Size, Trends, and Regional Outlook 2025-2035

- Pallet Tanks Market Size, Share, Trends, and Segment Analysis by Type, Application, and Region (NA, EU, APAC, LA, MEA)

- PTP Aluminum Foil for Pharmaceutical Package Market Size, Trends, Regional Outlook, Segments Analysis and Competitive Landscape

- Stretch Hooder Packaging Film Market Size, Trends, Segmentation, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape 2025-2035

- Single-use Pouches Market Size, Share, Trends, Segmentation, and Regional Outlook to 2035

- Compostable Tray Market Size, Share, Trends, Segments, and Regional Insights (2025-2035)

- Plastic Tray and Container Market Size, Trends, Segmentation, Regional Outlook and Competitive Landscape Report 2025-2035

- Recyclable Shrink Film Market Size, Trends, and Competitive Landscape: Global Industry Forecast to 2035

- Beer Glass Packaging Market Size, Share, Trends, and Forecast 2025-2035

- Dairy Aseptic Packaging Material Market Size, Trends, Segmentation, and Regional Outlook 2025-2035

- Duplex Paper for FMCG Market Size, Growth Trends, Segmentation, Regional Insights, and Competitive Landscape Forecast 2025-2035

- Plastic Turnover Box Market Size, Trends, Competitive Landscape, Global Industry Analysis, Segments, and Forecast 2025-2035

- Rigid Chilled Food Packaging Market Size, Share, and Forecast Analysis (2025-2035)

- Beverage Closures Market Size, Share, Trends, Segments, and Regional Outlook to 2035

- Compostable Shrink Wrap Market Size, Share, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Manufacturers, Suppliers, and Competitive Analysis 2025-2035

- Daily Chemical Product Stand Up Pouches Market Size, Share, Trends, and Forecast Analysis (2025-2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.